Where are we?

“Don’t ignore the wisdom of others. Receive wisdom skillfully, incorporate what’s useful, and let go of the rest.”

~Rick Rubin

It would be shortsighted to ignore why Jai Malik decided to shutdown Countdown Capital after more than 4 successful years (42% IRR for Fund I and 65% IRR for Fund II) and simply dismiss it as tough times.

He highlights structural difficulties that need to be addressed in order for early stage funds to work with multi-stage funds, and if handled correctly, I believe can create immense opportunities. Jai never explicitly went after vertical integration as a theme, but his area of focus in industrials led him to take advantage of the shift no differently than I did. Industrials and defense is where I see pricing getting expensive.

However, I disagree with Jai on the difficulty of investing alongside multi-stage funds. You have to work closely with multi-stage funds as they are important to the life of every startup. They’ve just pushed pricing up faster than the market can currently handle, so if you can still get a meaningful co-investment check in at a reasonable price you could be just fine.

Early Stage Pricing for Industrials and Defense (and AI) are Getting Expensive

1. Multi-stage firms have setup institutional sized early stage funds focused on Hard Tech making rounds pricey and very competitive. We no longer live in a world where big funds would only focus on Series A and beyond.

2. Multi-stage firms move in packs so this perpetuates the competitiveness and increase in valuations.

3. Valuations are topping out. We’re at the point in the cycle where late to the game multi-stage funds are writing checks at irrational prices into Hard Tech companies so they don’t feel left behind - we’ve seen this before.

4. Talent leaving primes, SpaceX, and Anduril, are starting to attempt the “Hadrian for X” playbook creating vertically built manufacturing for different categories.

5. Increased entry prices are boxing out potential early stage upside. This isn’t completely irrational behavior given the growth (in revenue & valuation) over the last 4 years for Hadrian, Varda, Albedo and many others, proving that quality assets and business models are viable in the sector. But what has become irrational are the entry prices for some of the new companies coming to market that have no track record or demonstrated business acumen.

5a. Increased entry prices for Pre-Seed and Seed Hard Tech companies means some firms will get discounts but don’t expect much, even for unproven founding teams with a lack of experience in their chosen sector or an overly ambitious science project. That’s ok for funds with a lot of money to level up ownership at later rounds but makes it really hard for small (<$100M) early stage hard tech funds to make meaningful returns.

5b. For a flood of multi-stage capital to enter a market with so few companies to pick through (unlike the plethora of SaaS business tools) this creates constraints in the ability for new entrants to get allocation, it also creates ‘synthetic hype’ into companies that are not good due to the ‘groupthink’ excitement in the category.

What’s Next

1. Big firms will, and are, for the most part taking their pro rata and in some cases leveling up. This is good for the ecosystem and good for the early stage funds that got in early at rational prices. This will create the path for more mature hard tech companies to continue to grow, leading to more companies getting started.

2. New founder talent is starting to decalcify due to secondaries and tender offers from previously illiquid stock options at companies like SpaceX/Anduril/etc. Additionally, I’m also seeing talent from pure software backgrounds make the leap into more complex use cases beyond enterprise software (exciting).

3. We will start to see failures in the ecosystem as cash reserves run low after large initial raises and a lack of customer/government traction - I suspect defense will get hit hard followed by science projects that couldn’t cross the valley of commercialization.

4. There have been a handful of irrational deals done in 2023 that will either never commercialize, the technical risk was greater than originally thought, or the pricing just didn’t make sense making their next round highly dilutive. These will come to light in 2024 helping to return to normal.

5. Vertically integrated companies will take center stage outside of industrials and defense - whether that’s an e-commerce business or a services company building their own software tools.

The Game is Just Getting Started for Complex Vertically Integrated Monopolies

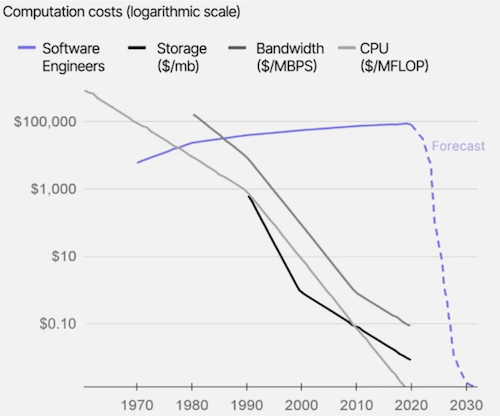

In my previous letter to LPs, I mentioned the chart below. This is showing a significant shift in where the next investable categories are effectively unlocking vertical integration.

Source: SK VenturesWe’re in the earliest innings of this larger shift as fully integrated software provides leverage to historically non venture scale businesses. We saw this with e-commerce (Amazon), automotive (Tesla), and even parking lots (Metropolis).

I’m extremely bullish on this greater shift taking place with the dropping cost of software development and that’s where Commodity Capital will be exploring for opportunities. Industrials/defense were just the beginning.

David Friedberg made this statement in the most recent All In Podcast regarding vertical integration and the downfall of vertical SaaS.

Summary: The low code tools and co-pilots are making it so easy for engineers to build most tools being used you should just build homegrown solutions at a very low cost. Which spells a tough future for enterprise software and SaaS as we know it.

Source: Youtube - All In Podcast 1.5.24VC Macro

“Here’s a Number that Might Surprise you”

“In the first six months of the year, California Public Employees’ Retirement System committed about $4.5 billion to venture capital funds, according to public filings.”

Kate Clark - The Information “Dealmaker: The Lone LP Doubling Down on Venture This Year”

This was caused by “the lost decade” where CaLPRS missed out on $11B of returns because of a pivot away from private equity after the Great Financial Crisis in 2008. What I’m seeing is that most fund of funds are making the same mistake CaLPRS made post 2008 because they got burned by the investments they made in pure play SaaS funds (more below on what happened) through 2020 - 2022 combined with a lack of distributions from older vintages.

Not only am I extremely bullish on VC going forward (duh, I’m raising and deploying a fund) but I see family offices stepping up to make investments in venture funds. Let me be clear venture capital as a category is not going anywhere, we needed the reset and the decade ahead should hold fantastic returns as trigger happy investors are washed out and this category of new industrial base startups are built and scale. The market for new industrial base startups is massive with a lot of opportunity and green field.

I’ve been spending a lot of time with family offices and the major advantage they had/have is diversification. Family offices always have something to sell allowing to rotate into categories they believe to have a bright future of growth. A round of applause to common sense and diversification.

Openview and Countdown Capital Announce Closures

Openview

Openview’s recent returns were a large factored in the suspension and layoffs. Its sixth fund, a $450 million vehicle raised in 2020, reported a net internal rate of return of -10%, according to documents. As of March, the median IRR for funds of that vintage was 13%, according to Cambridge Associates. The fund hadn’t returned any cash to limited partners, and the value of its portfolio was just $293 million, compared to the $350 million it used to make investments.

Why shutdown

1. Investing more money than in fund history at all time highs makes it almost impossible to show decent returns in an already difficult fundraising environment.

2. SaaS is becoming an ever increasingly difficult category to be investing in.

3. Founding partners were ready to exit and had a contingency plan in place that ultimately fell apart due to personal reasons by the next in line.

Learnings

1. Be patient and have a hard line on entry price

2. Who you decide to work with will make or break your success

Countdown Capital

Jai is more like a brother than a friend or co-investor. He achieved fantastic returns, with an implied net IRR of around 42% for Fund I LPs and around 65% for Fund II LPs. However, after a lengthy conversation with him, it became clear that it made sense for him to wind down his fund, which he had spent 4 years building. Jai never explicitly went after vertical integration as a theme but his area of focus in industrials led him to take advantage of the shift. Below, I have provided a condensed version of his reasons for shutting down and the lessons learned.

Why shutdown

1. Competition from multi-stage firms is outpacing value growth, reducing early-stage firms’ profitability in industrials.

2. While being focused strictly on industrials, the entry prices have over shot the window of meaningful profitability.

Learnings

1. I don’t necessarily agree with Jai’s take on it being hard to compete with multi-stage funds but when a founder wants to worth with one you don’t have a choice but to partner. This is nothing new as I mentioned above with regard to the $250M AUM early stage quote. I do agree as discussed at length above that pricing is getting expensive.

2. No different than a company, VC firms need to adapt and pivot continuously looking for markets with the highest possible growth. Our job as VCs is to find that next pocket of growth where pricing is not too competitive while being patient to find the right company at the right price.

3. The opportunity set is growing day by day as the cost of software development continues to drop and talent continues to flow in enabling opportunities for complex vertically integrated monopolies.

4. Patience is the name of the game in allocating capital and reaping rewards.

Summary

This is the most difficult era for venture capital and startups that we’ve seen since the dot com bubble. If you can stay patient, capitalized, and continuously evolve there will be light on the other side in the form of excess returns.

More VCs Enter the Space

Cerberus: not yet fully announced but they have spun up a practice helped run by Morgan Mahlock

CRV: Starting to build relationships within defense and space

Menlo Ventures: Announces an investment in True Anomaly’s $100M Series B financing and adds,

“At Menlo, we’ve been long-time partners in innovation for American progress—including companies that are building hardware and software products for the public sector (most sell to public and private sectors)”

A Slow End to 2023

The number of active VC firms, defined as making two or more deals in the first three quarters of 2023, plummeted 38% compared to the same period last year, PitchBook data shows.

Year-over-year change in US VC deal value, deal count and median valuation

Source: Pitchbook December, 2023

Macro

Soft Landing?

In my previous letters, I've discussed the possibility of a soft landing, which seems increasingly likely unless there is a significant unexpected event. Whether you interpret a more dovish Fed as a loosening of an overly tight policy or a Biden rate cut to boost his chances of re-election, it appears that there is a shift towards rate cuts and a soft landing. With that being said, we might see rate cuts around mid year or even earlier.

The dovish pivot is due to core inflation holding around 2.5% and a Fed Funds rate at 5.35% equating to an almost 3% real Fed Funds. This is an ultra tight policy.

What this Means for Venture

Using a Howard Marks quote from Further Thoughts on Sea Change,

“It seems obvious that if certain strategies were the best performers in a period with a given set of characteristics, it must be true that a starkly different environment will produce a dramatically altered list of winners.”

In the past few years, especially in a tighter rate environment, it has become evident that this statement holds true. This is not only true when comparing it to the 0% policy of 2020-2021, but also when looking further back to the mid-2010s, where we witnessed a remarkable series of successful venture outcomes. I am more confident than ever that now is the opportune time to raise and deploy a venture capital fund.

2024 Outlook

Vertical integration will take center stage as the next great operating model

More funds will publicly shutdown

Acquihires will reach an all time high as companies fail to extend their runway or to agree on new financing terms

Startups will start going public again - albeit at discounts to their last round but should start the dethaw the IPO market

Rate cuts by midyear

H2 ‘24 will show higher growth rates in capital deployment than we’ve seen over the last 1.5 years across all sectors of VC

More talent will unlock to leverage software in order build complex vertically integrated monopolies due to acquihires, employee stock option liquidity, and general excitement to not build another SaaS application

Defense startups will be the first amongst Hard Tech to shut down as they run out of money with 0 or very little government contracts to show

Bearish on startups building an application layer product using AI as their differentiator

More funds will join the the Hard Tech parade